capital gains tax uk

As a US citizen or Green Card Holder receiving dividends in the UK is a unique situation. Ad Its far easier to submit VAT returns using Xero compared to traditional desktop software.

Section 24 Capital Gains Tax Implications Facing Landlords Rita 4 Rent

Learn more about how HMRCs changes to digital tax filing are affecting you.

. Tell HMRC about Capital Gains Tax on UK. Work out tax relief when you sell your home. A capital gains tax CGT is the tax on profits realized on the sale of a non-inventory asset.

Capital Gains Tax rates in the UK for 202223. There is a capital gains tax allowance that for 2020-21 is 12300 an increase from 12000 in 2019. If you own more than one home and sell the one you dont reside in youll pay.

Theres no capital gains tax on individual gilts. Ad Get Support And Advice From The UKs Leading Independent Holiday Letting Agency. Ad A Financial Lawyer Will Answer Now.

You earn 227700 in taxable gains after any deductible expenses and the CGT allowance. How you report and pay your Capital Gains Tax depends whether you sold. Contact a Fidelity Advisor.

Something else thats increased in value. However the capital gains tax rate on shares are 10 for basic rate. The CGT allowance for one tax year in the UK is currently 12300 for an individual and double.

Taxes on capital gains for the 20212022 tax year are as follows. Your entire capital gain will be. 6 April 2010 to 5 April 2011.

Ad Its far easier to submit VAT returns using Xero compared to traditional desktop software. Tax when you sell property. Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

Questions Answered Every 9 Seconds. Our capital gains tax rates guide explains this in more detail. One of the significant tax every property owners have to pay is the capital gains tax.

Remember the yield-to-maturity is made of two. First deduct the Capital Gains tax-free allowance from your taxable gain. The subsidiary is a trading company ie one whose income is substantially.

Offshore investors are required to pay UK Capital Gains Tax when they dispose of their property. With Years Of Experience We Can Help You At Any Stage Of Your Holiday Letting Journey. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

100000 12300 allowance 87700 taxable. Capital gains tax rates for 2022-23 and 2021-22. In your case where capital gains from shares were 20000 and your total annual earnings were 69000.

You sell a buy-to-let flat for 250000 which you originally bought for 150000. Your annual salary is. In simple terms capital gains mean the selling price less acquisition.

Add this to your taxable. 20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property from 6 April 2015. 10 18 for residential property for your entire capital gain if your overall annual income is below 50270.

A residential property in the UK on or after 6 April 2020. Capital gains recognized on the sale of shares in foreign or UK subsidiaries are exempt from tax provided that. Learn more about how HMRCs changes to digital tax filing are affecting you.

What you need to do. May 18 2020. Tax if you live abroad and sell your UK home.

If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax. Based on your salary only youre a basic rate tax. Capital gains tax rates on property UK are 18 for basic rate taxpayers and 28 for high rate taxpayers.

Tax when you sell your home. At last we get to the much-trailed important bit about capital gains tax on gilts. 250000 150000 100000 profit.

Lets start with what is capital gains. For any residential property disposed on or after 27 October 2021 the reporting. A 10 tax rate on your entire capital gain if your total annual income is less than 50270.

Capital Gains Tax CGT usually applies to taxpayers who live in the UK but special rules bring expats and other non-residents into the tax net if they make a profit. The Capital Gains Tax is a fee that the UK puts on selling a home that is not your primary home.

Capital Gains Tax In Scotland How It Works And What To Be Aware Of

Tax Rates And Allowances Latest Tax Facts And Insights 2019

Capital Gains Tax Low Incomes Tax Reform Group

How Capital Gains Tax Changes Will Hit Investors In The Pocket Burns Webber Estate Agents

Tax Efficient Etf Investing Justetf

The Ideal Approach To Reduce Your Capital Gains Tax For Your Company By Shubharm Issuu

30 Day Deadline For Capital Gains Tax Whyfield Accountants

How To Avoid Capital Gains Tax On Property Uk

Taxing Capital Gains At Ordinary Rates Evidence Says Do It So Does Buffett Jared Bernstein On The Economy

Capital Gains Tax Examples Low Incomes Tax Reform Group

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

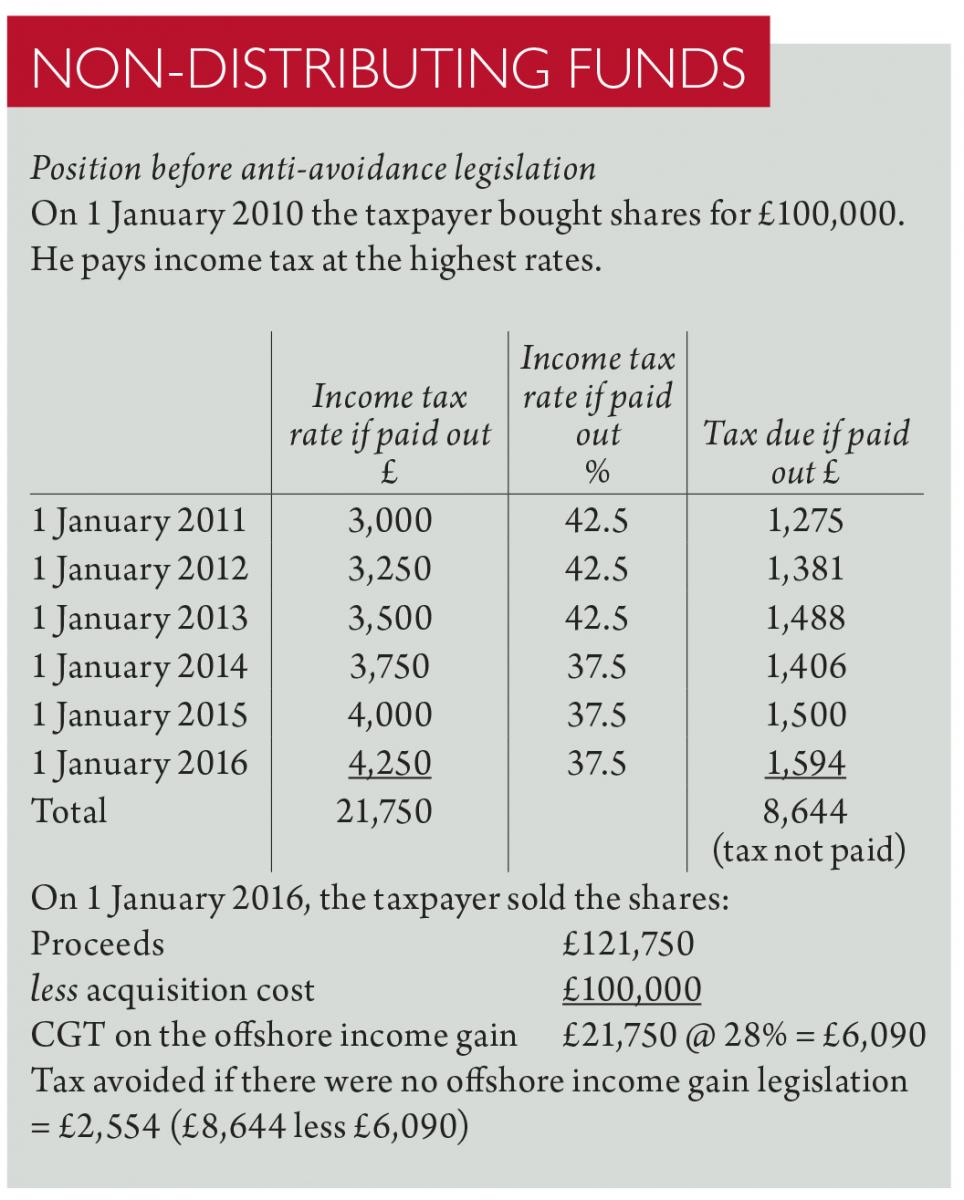

Taxation Of Capital Gains For Individuals And Companies Taxation

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

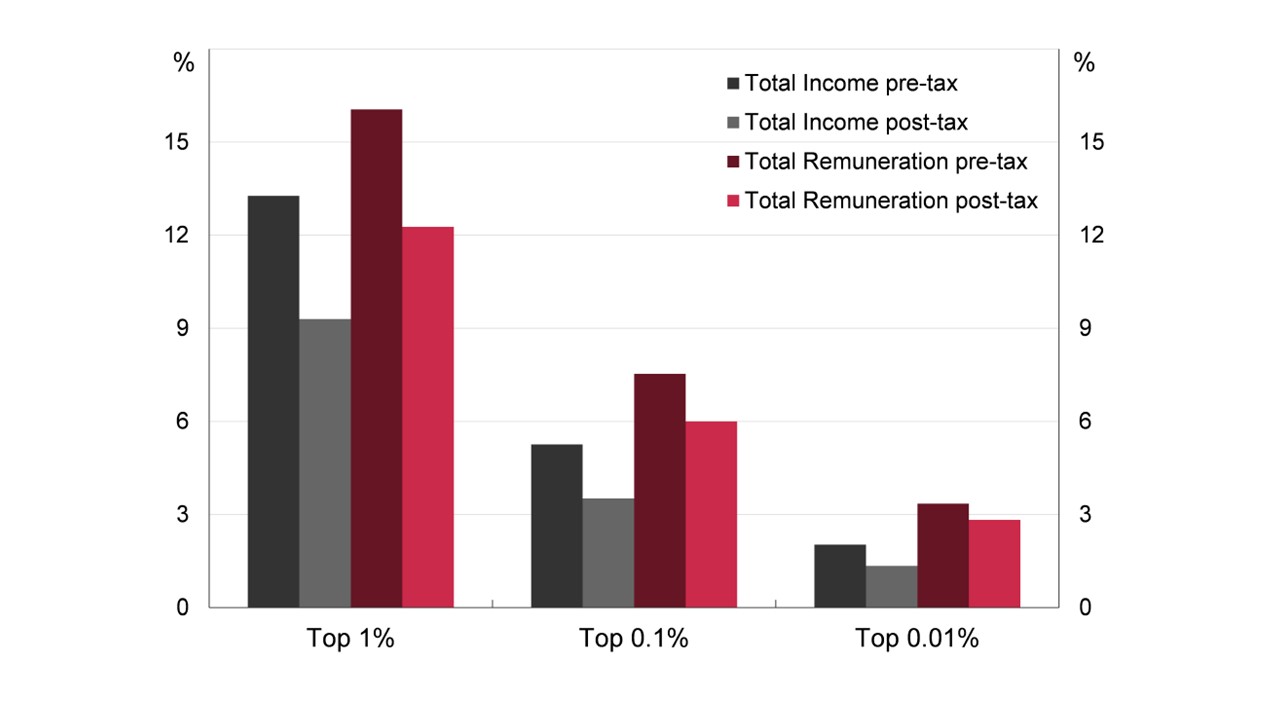

Capital Gains And U K Inequality Wid World Inequality Database

Alex Picot Trust A Look At The Tax Implications Of Holding Uk Residential Property

Main Residence Property Sale New Capital Gains Tax Implications Kirk Rice